website innovation guide: why keeping your website current is critical. a case study.

Laura Robbins, Corporate Marketing Manager

Laura Robbins, Corporate Marketing Manager

Ditch the idea that your website is a sleepy expense. Think of it as your 24/7 digital sales machine and your most valuable secret weapon.

Yet, many businesses treat it as a static property, accepting the invisible decay of performance, security, and user experience. Stagnation is fiscally irresponsible. Continuous website innovation is the single most effective way to secure your growth and guarantee your digital relevance.

Here’s the proof.

key takeaways.

- A website that isn’t continuously updated loses conversions, visibility, and trust over time.

- Website speed directly affects conversion rates, bounce rates, and search rankings.

- Outdated websites significantly increase security and financial risk.

- Flexible website systems outperform rigid templates in engagement and conversion.

- Improving engagement and goal completion turns websites into measurable growth assets.

- Continuous website innovation is more cost-effective than periodic full rebuilds.

the financial fallout of stagnation.

The cost of a neglected website is quantifiable, manifesting as lost revenue and escalating risk. These industry statistics are your warning signal:

1. the cost of slow performance.

The modern user has zero patience. The moment your site exceeds the two-second mark, you are bleeding traffic and profit. We don’t know about you, but two seconds seem to pass quickly.

- conversion crisis: A one-second delay in mobile load times can impact conversion rates by up to 20%. For B2B sites, a site loading in 1 second has a conversion rate 3 times higher than a site that loads in 5 seconds. Yowza.

- bounce rate penalty: The probability of a user immediately abandoning your site (bouncing) increases by 32% as page load time goes from 1 second to 3 seconds.

- seo failure: The average page speed of a first-page Google result is 1.65 seconds. If your site is slower, you are actively choosing to rank lower than your competitors. Nobody wants that.

- The global average cost of a data breach is $4.44 million, climbing to $10.22 million for U.S. organizations—figures that can be devastating for mid-market operators and community institutions.

- Legacy platforms and outdated plugins are the most common attack vectors, often exploited simply because patches and updates were delayed or impossible to deploy quickly.

- For smaller organizations, recovery costs typically range from $120,000 to $1.24 million, excluding lost business, operational disruption, or reputational fallout—a burden that can hinder growth or threaten long-term viability.

2. the catastrophic security risk.

Yes, we said catastrophic. Hear us out. An outdated website is a liability waiting to happen. Unpatched, legacy platforms are prime targets, making a security breach a matter of when, not if.

Property websites often integrate with leasing platforms, CRMs, payment portals, and third-party plugins. When those sites run on legacy systems or unpatched software, they become an easy entry point for attackers — putting resident data, payment information, and operational systems at risk. A single breach can impact multiple properties at once, triggering downtime, lost leasing momentum, remediation costs, and long-term damage to brand trust across an entire portfolio.

For financial institutions, the stakes are even higher. Outdated web infrastructure exposes sensitive customer data and creates compliance risks across regulations such as GLBA, PCI-DSS, and FFIEC guidelines. A breach doesn’t just carry financial consequences — it can result in regulatory scrutiny, mandatory disclosures, reputational harm, and erosion of member trust that takes years to rebuild.

3. the financial reality.

In both industries, the takeaway is clear: security isn’t a one-time project. It’s the byproduct of a modern, well-maintained website ecosystem

case study: from stagnant to scalable with peakmade.

What good is all this data? Here’s a real-world example of a Threshold client whose digital presence was limiting growth—not because of a lack of effort, but because the website itself had become a bottleneck.

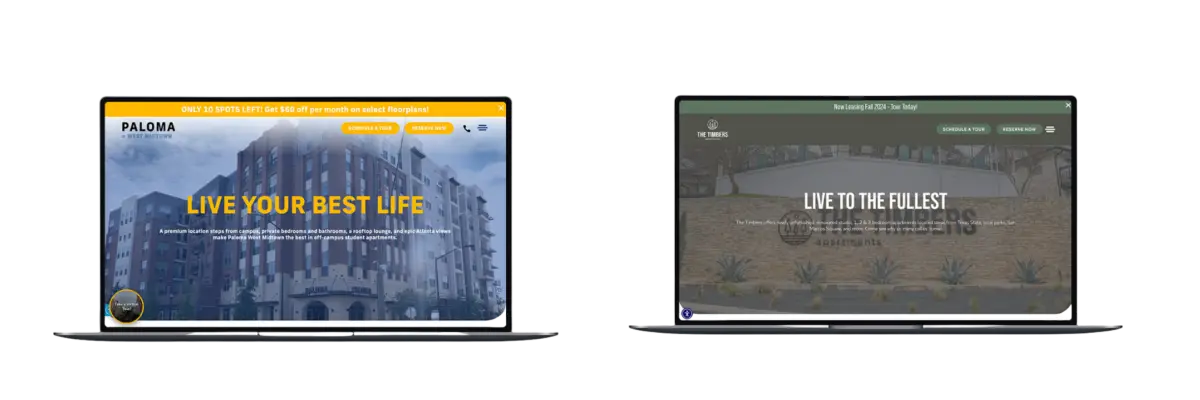

PeakMade, a multifamily real estate investment and management company, managed a portfolio of property websites that were functional but inflexible. Built on templated systems, these sites weren’t optimized to adapt, engage, or convert at scale. Threshold didn’t just redesign with nicer visuals — we focused on the core performance signals that actually drive business outcomes.

before.

PeakMade’s property websites relied on standardized templates that offered little room for optimization. Engagement plateaued, visitors didn’t linger, and the number of sessions was too few to result in meaningful actions. While the sites technically “worked,” they weren’t working hard enough for the business.

after.

We designed a flexible and scalable website system for PeakMade, aligning UX, content structure, and performance optimization across their entire portfolio. The result was a clear shift in how users interacted with the sites and how effectively those interactions translated into business value.

| METRIC | INNOVATIVE WEBSITE PERFORMANCE | BUSINESS IMPACT |

| Average Time on Site | +33 seconds | Visitors spent more time exploring listings and content, indicating stronger engagement and intent. |

| Engagement Rate | +7.74% | Increased interaction across pages signaled a more intuitive, compelling experience. |

| Goal Conversion Rate | +77.61% | Significantly more visitors completed key actions, directly increasing the effectiveness of marketing and leasing efforts. |

| Portfolio Scalability | Unified, flexible system | Teams gained the ability to improve and evolve sites without rebuilding from scratch. |

Using the Entrata designs and limited plugins was costing PeakMade properties conversions. By working in conjunction with Threshold, these four website templates not only look better than the previous property websites, but they also provide a much-improved user experience that consistently results in better website engagement and higher lease numbers.

your website cannot wait.

The case of PeakMade is a vivid reminder: Your website is a competitive tool. The longer you wait to innovate, the more expensive the catch-up will be, and the more market share you will surrender to competitors who prioritize continuous improvement.

Stop viewing your website as a fixed asset. Start treating it as a dynamic, high-yield investment.

Abby Barnes

Abby Barnes

Laura Robbins

Laura Robbins